Politics & Government Murphy Greenlights $56B New Jersey Budget: See The Breakdown The state budget will make a big impact on taxes, schools and transportation. Here’s the short version – plus a deeper dive into the action.

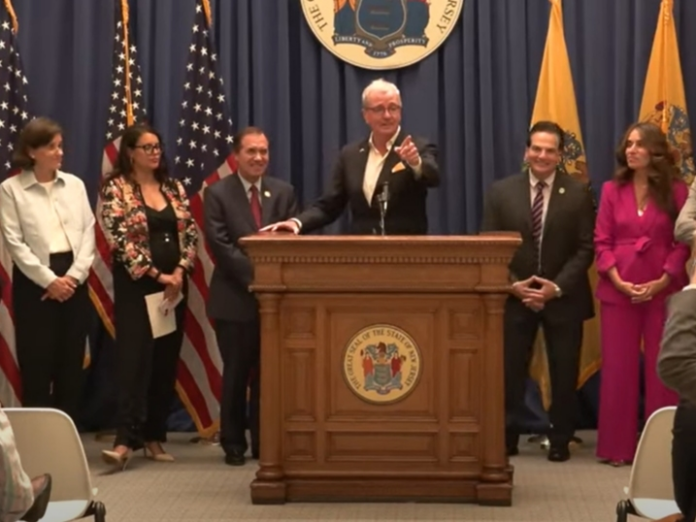

New Jersey Gov. Phil Murphy signed the fiscal year 2025 Appropriations Act into law on Friday. The Senate and Assembly both passed the legislation earlier that day. (Photo: New Jersey Office of the Governor)

NEW JERSEY — New Jersey’s latest state budget has finally crossed the finish line after months of controversy, advocacy and deal-making.

Gov. Phil Murphy signed the fiscal year 2025 Appropriations Act into law on Friday (watch the video below). The $56.7 billion budget will have some big impacts on people and businesses across the Garden State, including taxes, education and transportation. Need the “TLDR version?” Highlights of the state’s latest spending plan include:

Puts more than $27 billion into property tax relief (includes funds for three key programs: ANCHOR, Stay NJ and Senior Freeze)

Has the “highest level of school funding” in state history (including aid for local state aid, free pre-K and community college)

Creates a 2.5 percent additional tax on corporations that earn more than $10 million per year, which will fund NJ Transit (expires in fiscal year 2029)

Makes a “record full pension payment” of $7.16 billion

Contains a $6.1 billion surplus (the state’s so-called “rainy day fund”) “With this budget, we are going to make life more affordable for more families,” Murphy said. “We are going to create new economic opportunities for our workers and local businesses. And we are going to invest in the potential of every one of our neighbors — from our students to our senior citizens.” “But above all, this is a budget that will put the needs of our families ahead of special interests, starting by providing yet another round of record-high tax relief to our state’s working- and middle-class families,” the governor added.

The budget got support from some key lawmakers as it crossed the finish line. “This budget is not just about balancing books … it’s about balancing the scales of opportunity and equity for all New Jerseyans,” Assembly Budget Committee Chair Eliana Pintor Marin said.

Senate Budget Committee Chair Paul Sarlo said the spending plan “builds upon our record of fiscal responsibility,” adding that it will “serve the best interests” of New Jersey. Not everyone had such glowing reviews, though.

Sen. Kristin Corrado said it was easy for her to vote no on the spending plan, writing that the state budget has grown by a “staggering” 60 percent since Murphy assumed office. “This budget lacked transparency and saw cuts to school districts, slashed municipal aid, imposed new taxes and fees, canceled the sales tax holiday for parents and teachers, and included pork projects like building a tiki bar at a yacht club,” the senator added. See a budget summary from the governor’s office here. See a line item veto summary here. PROPERTY TAXES Nearly half of the entire budget — more than $27 billion — will be dedicated toward providing relief for homeowners in a state with one of the highest property tax rates in the nation.

The budget includes more than $3.6 billion for direct property tax relief, including the third year of the Affordable New Jersey Communities for Homeowners and Renters (ANCHOR) program, which provides tax relief to people who own or rent property in New Jersey as their principal residence (income limits apply). The budget provides more than $200 million to pre-fund the “Stay NJ” property tax relief program, which would cut tax bills for homeowners over the age of 65 with incomes up to $500,000. The controversial plan is expected to launch in fiscal year 2026. See Related: NJ Tax Cut Plan Is For The Rich, Critics Say Another carveout that boosts older homeowners – the popular Senior Freeze program – will be maintained in the 2025 budget. The program reimburses eligible senior citizens and people with disabilities for property tax or mobile home park site fee increases. It was expanded last year to include 58,000 new households, the governor’s office said. The budget maintains recent expansions of the Earned Income Tax Credit, the Child and Dependent Care Tax Credit, and the Child Tax Credit, which was doubled last year to enable families with young children to receive up to $1,000 per child. EDUCATION

According to Murphy’s office, the budget “yields the highest level of school funding in history.” New Jersey has increased overall K-12 support to its public schools by more than $3.5 billion over seven years – more than a 40 percent increase – which also helps to lower local property taxes. The governor previously said the state’s school funding formula will be “fully funded” for the first time: a major sign of progress for New Jersey. That formula was part of the School Funding Reform Act of 2008, which aimed to address school funding inequities. While many districts have received additional funding, more than 200 have seen aid cuts yearly since 2018, as a result of the revision to the SFRA known as S2 that was signed into law by Murphy. The 2024-25 fiscal year is supposed to be the last year of S2 and its cuts.

School districts across the state have been announcing layoffs this year as a result of diminished state aid, inflation or both – and many aren’t happy about it. Read More: 200+ NJ School Jobs To Be Axed, Despite $44.7M In Last-Ditch State Aid

The budget also supports an ongoing drive to provide “universal” pre-kindergarten in local school districts across the state. It authorizes an extra $124 million for pre-K education, including a $20 million earmark that will be used to create more than 1,000 new seats in new districts. Read More: NJ Commits To ‘Universal Pre-K For All’ At the other end of the educational spectrum, community colleges will get more than $290 million in state aid – up from the $134 million that was spent during the final year of Chris Christie’s administration before Murphy took office. Read More: New Jersey’s ‘Free Community College’ Program Is Now Permanent Other carveouts include $2 million to help support the merger of Bloomfield College and Montclair State University, according to Sen. Renee Burgess. CORPORATE TRANSIT TAX The budget gives a final green light to a controversial new “corporate transit fee” that will give a financial boost to NJ Transit at the expense of some of the state’s wealthiest businesses.

Corporations earning more than $10 million per year in New Jersey will be hit with an extra 2.5 percent tax, which will help NJ Transit to run trains and buses in the state. See Related: Tax Corporations, Fund Trains; Shoving Match Intensifies In New Jersey Supporters of the tax hike say that only the largest corporations in the state will be impacted – many of which don’t even have a headquarters in New Jersey. But critics argue that the tax will lead to job losses if big businesses decide to pack up their bags and leave. The new tax will sunset in 2029. “This shows that when we prioritize real people over record-breaking corporate profits, we can fund the types of public services that make New Jersey a great place to live,” said Peter Chen, a policy analyst with nonprofit think tank New Jersey Policy Perspective, which recently released an updated report in support of the corporate transit tax. NJBIA president and CEO Michele Siekerka disagreed, calling the new tax a “terrible policy, not just for businesses, but for New Jersey residents, consumers and workers.”

It isn’t the first time the group has criticized the tax, Siekerka pointed out. “It is on top of other major businesses taxes levied by this administration,” she said. “It will have little to no benefit for impacted employers. It is punitive and damaging in its retroactivity. It wholly worsens our business reputation. It is not needed this year. And it quite likely won’t be used solely for its stated intent: NJ Transit.” PENSIONS AND SURPLUS According to the governor’s office, the fiscal year 2025 budget makes a “record full pension payment” of $7.16 billion, including contributions from the state lottery. “We are heartened that this budget makes the required full pension payment – for the fourth year in a row – following decades of administrations of both political parties failing to do so,” Communications Workers of America Union (CWA) District 1 Vice-President Dennis Trainor said.

Meanwhile, the budget includes a surplus of $6.1 billion, an amount that the governor’s office said is sufficient – but which the New Jersey League of Municipalities pointed out is a decrease of more than $2 billion from last year’s “rainy day fund.” VETERANS, ARTIFICIAL INTELLIGENCE AND MORE The budget provides more than $30 million in funding for a two-year initiative that aims to end veteran homelessness with a big goal: help place over 1,000 homeless veterans in New Jersey into “stable housing.” There is also money to advance the use of artificial intelligence (AI) in New Jersey, the governor’s office said: “The budget includes a suite of initiatives to advance the governor’s AI Moonshot and augment the AI Hub being created at Princeton University. The funding includes $4 million to establish an innovation challenge to reward innovators for solving public-facing problems with state data; $400,000 to fund the AI-focused Global Entrepreneurs-in-Residence pilot program to help international students at New Jersey universities launch cutting-edge businesses; $1.5 million to fund AI education in K-12 classrooms and develop new career and technical education programs targeted to AI; and $2 million to help budding entrepreneurs build out start-ups related to general artificial intelligence and connect with the AI innovation hub.” Other budget highlights include:

Allocates more than $100 million of growth to support Cover All Kids, which provides health coverage for children

Includes $82.5 million to maintain expanded eligibility for the Pharmaceutical Assistance for the Aged and Disabled (PAAD) and Senior Gold programs, which aim to cut costs for certain prescription drugs

Provides funding for the RetireReady NJ program (formerly known as the Secure Choice Savings Program)

Includes an additional $30 million to provide free school meals

Allocates over $15 million for teacher training programs and $5 million to launch a “Nursing Workforce Initiative”

Continues funding for the Main Street Recovery Program

Adds an extra $10 million (nearly double last year’s investment) for the ARRIVE Together program, which “brings police and mental health professionals together to respond to crises”

Includes over $40 million for the NJ Statewide Student Support Services network, and over $50 million for cost-of-living increases in the Children’s System of Care and new Mental Health Initiatives

Allocates more than $23 million to expand New Jersey’s universal home visitation program for new mothers from 2,200 families this year to 16,700 families next year Advocacy groups in New Jersey pointed out that the budget also contains some other earmarks that people should know about. They include: ENERGY – “The fiscal year 2025 budget includes $805 million for the Energy Tax Receipts Property Tax Relief Aid; the $150 million Municipal Relief Fund that was included in SFY24 to supplement Energy Tax Receipts is not included in the SFY25 budget” (as per the New Jersey State League of Municipalities) REPRODUCTIVE HEALTH CARE – “The budget invests a combined sum of $50 million in reproductive health care services, infrastructure improvement and support for providers, including: $30 million for family planning services, $10 million for facilities improvements, $5 million for security enhancements, and $5 million for training grants” (as per Planned Parenthood Action Fund of New Jersey) ENVIRONMENT – “Increased state funding for the DEP … These investments will give the agency more resources to protect our air and drinking water” (as per the New Jersey League of Conservation Voters) CAPITAL PARK – “[The budget includes] $5 million in funding for the construction of Capital Park [in Trenton]” (as per New Jersey Future)